India’s Fine Fragrance Market: The Shift Toward Premium and Personalized Scents (July 2025 - Dec 2025)

Jan 05, 2026

As Indian consumers continue to embrace fragrance as a form of self-expression rather than a functional add-on, the fine fragrance market is set to become one of the most dynamic and premium-driven segments within beauty and personal care, with fine fragrance brands playing a central role in shaping aspiration and category growth.

The Indian Fine Fragrance Market

- India’s fine fragrance market is undergoing a notable shift from a largely functional category to one driven by emotion, identity, and lifestyle expression.

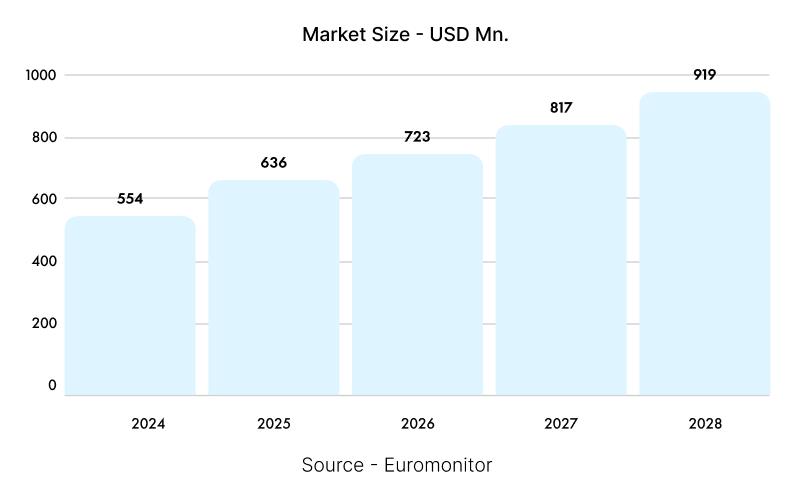

- The market is projected to grow from USD 554 million in 2024 to USD 919 million by 2028, registering a strong CAGR of ~13.4%. [1]

- This growth highlights fragrance’s evolution into a key pillar of the BPC ecosystem, supported by increased innovation and premiumization among fine fragrance brands.

Market Growth Drivers

Fine Fragrance Sales by Category

AARAV’s Fine Fragranced Outlook 2025-26

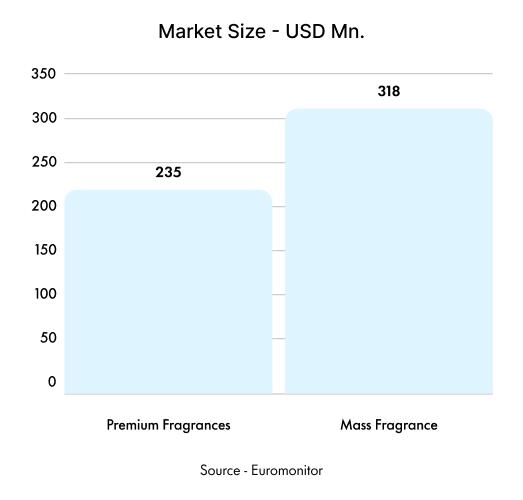

Develop differentiated fragrance strategies for mass and premium segments. While mass fragrances should prioritize familiarity, longevity, and affordability, premium fine fragrance brands can focus on complexity, storytelling, and distinctive ingredient signatures.

Smaller pack sizes, discovery sets, and travel sprays can lower entry barriers and encourage consumers to explore new scent profiles and fine fragrance brands without high upfront commitment.

While global fragrance trends influence aspiration, adapting them to Indian preferences—such as climate suitability and cultural scent associations—will allow fine fragrance brands to improve relevance, adoption, and long-term loyalty.

FAQs

[1] Euromonitor Login. (n.d.-b). https://staging-login.euromonitor.com/