A Comprehensive Analysis of Category-Wise Growth in India’s Personal Care Market(June 2024 - June 2025)

Dec 05, 2025

The personal care landscape in India is evolving rapidly, shaped by rising consumer awareness, premiumization, and a growing appetite for specialized products. As consumers diversify their routines and seek more targeted solutions, certain categories have emerged as clear leaders, while others continue to carve out their space within the market.

The current category-wise distribution reveals how preferences are shifting across Bath & Shower, Hair Care, Skin Care, and beyond. For brands and every fragrance supplier, these shifts provide strong direction for formulation and innovation.

Cutting - Edge Innovations

Skinification of Haircare

This involves applying skincare principles to haircare, using skincare- like actives to boost scalp health and overall hair quality - —an area where a fragrance supplier can support with functional and sensorial fragrance technologies.

Ayurveda and Modern Science Integration

Brands are combining traditional Ayurvedic ingredients with modern science to deliver skincare solutions that are both time-tested and scientifically validated, increasing collaboration opportunities with every premium fragrance supplier looking to develop authentic, ingredient-led olfactive stories.

Multi-Functional Products

The market is witnessing a rise in multifunctional products—like moisturizers with SPF or conditioners that double as serums— designed for consumers seeking efficient, time- saving beauty routines. This opens new innovation pathways for a fragrance supplier to craft smart, hybrid scent profiles that align with multi-benefit formulations.

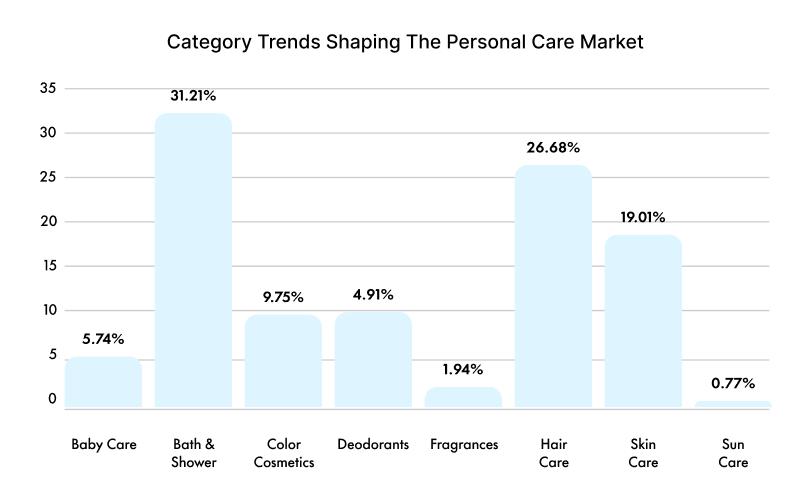

Category Trends Shaping The Personal Care Market

- Bath & Shower products hold the highest share at 31.21%, reaffirming their position as the largest and most essential category in the personal care market.

- Hair Care follows closely with 26.68%, demonstrating its role as a core routine category supported by rising consumer interest in scalp health, natural formulations, and premiumization.

- Skin Care accounts for 19.01%, showcasing sustained momentum as consumers increasingly prioritize targeted solutions and everyday skincare regimens.

- Baby & Child Specific Products represent 5.74%, marginally ahead of Deodorants at 4.91%, both categories reflecting steady, need-based demand with moderate room for innovation.

- HafghFragrances hold a smaller share at 1.94%, suggesting niche but growing potential, particularly with the rise of fine fragrances and lifestyle scents.fh

- Adult Sun Care, at just 0.77%, remains the least represented category, highlighting significant white space for growth as awareness of sun protection and preventive skin health increases. [1]

AARAV’s Personal Care Outlook 2025-26

Build Hybrid & Multi-Functional Essentials

Launch high-usage Bath & Shower and Hair Care products with added skincare benefits (e.g., microbiome-friendly washes, scalp serums-in-shampoo) to tap into “skinification” and increase consumer value perception.

Ayurveda-Backed Premium Ranges

Develop modern Ayurvedic lines across Skin and Hair Care using clinically validated ingredients (e.g., bakuchiol, kumkumadi, amla peptides) to attract ingredient-conscious and premium-seeking consumers —supported by a fragrance supplier capable of delivering authentic, experiential Ayurvedic scent profiles.

Unlock White-Space Categories

Introduce accessible, everyday-use Sun Care and fine fragrance hybrids (e.g., sunscreen serums, perfumed body mists with skin benefits) to expand penetration in the lowest share but fastest-growing opportunity zones.

FAQs

FAQ 1: How is the shift toward premiumization influencing fragrance innovation in personal care?

Premiumization across Bath & Shower, Hair Care, and Skin Care is driving demand for more sophisticated scent profiles and functional fragrances. Brands increasingly want to create own fragrance identities that differentiate them in crowded categories. This includes ingredient-led storytelling (e.g., Ayurvedic herbs, scalp actives) and long-lasting sensorial experiences that elevate daily-use products into lifestyle offerings.

FAQ 2: What role does “Skinification of Haircare” play in fragrance development?

As haircare adopts skincare-like ingredients (niacinamide, peptides, microbiome actives), fragrances must align with this elevated positioning. Brands now aim to build your own fragrance concepts that communicate scalp health, clinical efficacy, and premium care. Clean, serum-like, botanical, and wellness-inspired scent profiles are becoming more relevant than traditional heavy perfume notes in this category.

FAQ 3: How can aromatherapy positioning boost growth in Bath & Shower products?

With Bath & Shower holding the largest market share (31.21%), incorporating wellness-driven fragrances offers strong differentiation. Partnering with credible aromatherapy oils suppliers allows brands to integrate functional essential oils like eucalyptus, lavender, or rosemary for relaxation and stress relief. This enhances both sensorial appeal and perceived product benefits.

FAQ 4: Why is collaboration with aromatherapy oil manufacturers important for Ayurvedic product lines?

As Ayurveda merges with modern science, authenticity becomes crucial. Working with reliable aromatherapy oil manufacturers ensures ingredient traceability, purity, and performance consistency. This supports brands launching clinically validated Ayurvedic ranges while strengthening consumer trust in both efficacy and olfactive storytelling.

FAQ 5: How can brands leverage aroma oil suppliers in developing multi-functional products?

Multi-functional formats (e.g., SPF moisturizers, serum-conditioners) require fragrance systems that remain stable across complex formulations. Experienced aroma oil suppliers help design adaptable fragrance bases that perform across hybrid textures while maintaining product stability, longevity, and compliance standards.

FAQ 6: Is there growth potential for fragrance oils in white-space categories like Sun Care?

Yes. Adult Sun Care (0.77%) represents a major growth opportunity. Lightweight sunscreen serums, perfumed mists with UV protection, and after-sun calming gels can benefit from customized scent profiles. Brands looking to make fragrance oil blends that align with sun care must focus on freshness, skin-compatibility, and low photo-reactivity to ensure safety and performance.

Sources -

[1] Euromonitor Login. (n.d.-b). https://www.portal.euromonitor.com/analysis/tab